What is credit score?

A credit score is usually a three-digit number that lenders use to help determine whether you get a mortgage, a credit card, or some other line of credit and the interest rate you are charged for this credit. Simply put, your credit score helps the lender determine your credit risk at the time of your credit application.

“Bad credit is better than no credit at all.”

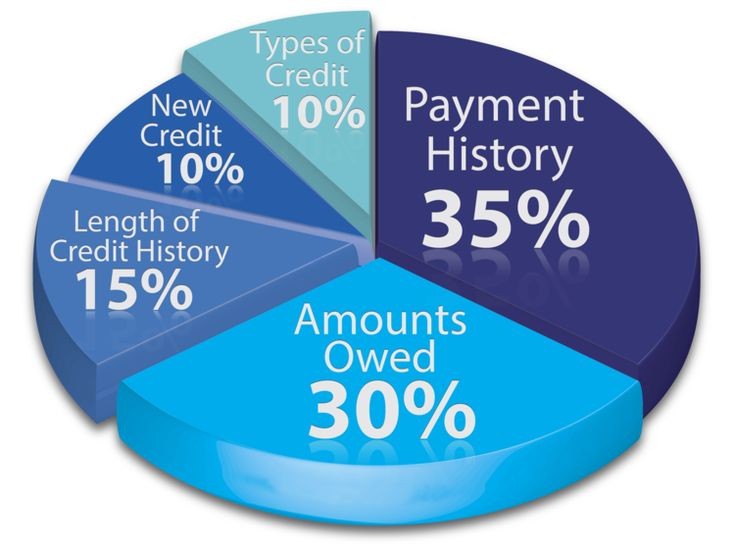

5 factors that determine your credit score

There are 5 factors of differing importance that determine your credit score.

• 35% is payment history

How often you pay your accounts on time is the biggest factor. Paying on time affects your score positively, whereas late payments may lead to a lower credit score.

• 30% is how much you owe

How much you owe plays a big role in your credit score. The lower your debt, the better. Low debt has a positive effect, whereas high debt has a negative effect on your credit score.

• 15% is the length of history

The length of your credit history affects your score. A longer credit history of responsible credit use leads to a positive effect on your credit score, whereas a long history of irresponsible credit use can lead to a negative effect on your credit score.

• 10% the type of credit used and the last

Having different credit lines has a positive effect on your credit score, whereas having only one type of credit line has a negative effect on your credit score.

• 10% is determined by new credit history

Opening several credit accounts in a short period of time affects your credit score negatively, whereas spacing out the opening of new credit accounts after a reasonable period of time affects your credit score positively.

What is the importance of a good credit score?

• Better rates on your car insurance.

• Get better interest rates on your mortgage.

• Pay less on security deposits.

• Improve your chances of credit card and loan applications.

• Increase your approval chances of rental applications.

How can a young adults build a good credit record?

• Educate yourself

Before getting credit, you need to educate yourself on credit. This will have the best effect on your credit score because it fully equips you with the dos and don’ts of credit.

• Get started on credit

We all know that in order to see results from something, we have to start, so the same goes with building a good credit record; you have to apply for credit. However, make sure that it is realistic; you do not want to apply for credit that is too high and will bring you into debt.

• Avoid applying for credit multiple times, too frequently.

Applying for credit too frequently can lower your credit rating because it gives the impression to lenders that you are desperate for credit. The other personal downfall is that you might have way too many credit facilities to manage.

• Set up payment reminders to pay your dues on time.

All credit has due dates for payments, so setting reminders to ensure you pay all your credit accounts on time will positively affect your credit score.

• Clear debt.

If you already have credit card debt, create a realistic payment plan that ensures you pay off your existing debt. This will inevitably increase your credit score.

• Be a good payer

All lenders want a good borrower to lend to. Being a good payer reflects on your credit score and will increase it.

• Review your credit record for accuracy.

This only applies if you already have credit. Taking the time to review your credit record goes a long way because it can help you dispute errors on your record. Where can you check your credit record in Namibia? There are currently only two credit bureaus registered with the Bank of Namibia, and they are: Compuscan Credit Reference Bureau (Pty) Ltd. and TransUnion Credit Bureau Namibia (Pty) Ltd.All Namibian consumers have the right to access their free credit report once a year. You can get your free credit report by sending an email to Namibia-freereport@transunion.co.za. You can also visit TransUnion’s offices in Windhoek from Monday to Friday between 10 a.m. and 1 p.m.

This article has shed light on what a credit score is, the five factors that make up a 3-digit credit rating, and how you, as a Namibian youth, can work on establishing a good credit history. In the next article, we will look at credit hacks and how they affect your credit record.