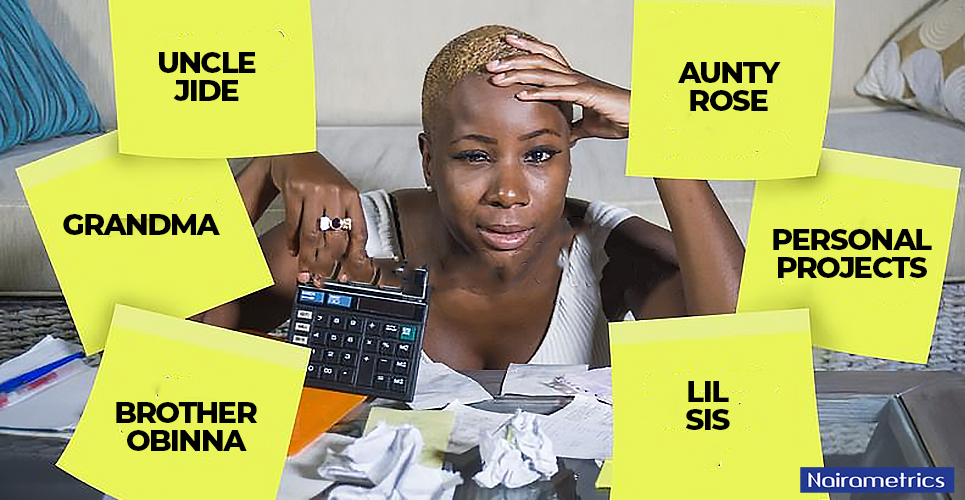

Addressing the concept of “black tax” is crucial, especially considering its significant impact on young professionals in Southern Africa. By defining it, exploring its effects, and offering strategies to navigate it, this article can provide valuable insights to those grappling with its challenges.

What is black tax?

By definition, black tax describes the financial responsibilities that black professionals often have towards their families and communities. It refers to the expectation or obligation that individuals who have achieved success or higher income levels should financially support their less fortunate relatives or communities. It can sometimes create a significant financial burden on those who are expected to contribute.

What is the impact of black tax to the finances of young professionals?

Young professionals’ finances may be significantly impacted by black tax in a number of ways:

1. Diminished disposable income: Because they support their families financially, young professionals may have less money available for personal savings, investments, or discretionary spending.

2. Delayed financial milestones: The financial requirements of black tax may cause saving for significant financial milestones, like home ownership, raising a family, or investing in additional education, to be delayed.

3. Limited career mobility: In order to fulfill the financial demands of black tax, some young professionals may feel pressured to forgo their passions in favor of higher-paying positions.

4. Increasing debt: Young professionals may turn to borrowing money or using credit cards to satisfy their financial obligations, which can result in higher debt and long-term financial distress.

5. Emotional stress: For young professionals, juggling personal financial objectives with the duty to provide for family members can lead to emotional strain and guilt.

How can young professionals navigate black tax in a way that works for their personal finances?

Careful preparation and communication are necessary to manage personal finances while navigating black taxes. The following are some tactics for recent graduates:

1. Set clear boundaries: Be open and honest with family members about your financial situation, including your capabilities and limitations. Finding a balance between providing for your loved ones and looking out for your financial security is crucial.

2. Establish a budget: Make sure your budget takes care of your family’s needs as well as your own financial objectives, such as emergency savings, retirement savings, or personal aspirations.

3. Set financial priorities: Choose which financial objectives are most important to you and spend your resources appropriately. This could entail allocating a specific portion of your earnings to supporting your family and allocating funds to reaching your personal financial goals.

4. Invest in education: Family members will be less dependent on your help in the long run if you encourage them to pursue education and skill development to improve their own financial circumstances.

5. Get financial advice: You can think about consulting a financial advisor, who can assist you in creating a thorough financial strategy that takes into account your responsibilities to your family as well as your own objectives.

6. Create a network of support: Get in touch with other young professionals who might be dealing with black tax in a similar way. Sharing tactics and experiences can offer insightful information as well as emotional support.

7. Look into alternate support networks: Look into local services, government initiatives, or nonprofits that could be able to help your family members, reducing some of the financial strain on you.

Young professionals may handle this responsibility in a way that supports both their personal financial well-being and their ability to fulfill their duties to their families and communities by managing black taxes proactively.

In general, black tax can impede young professionals’ capacity to grow financially and develop their wealth, making it more difficult for them to meet their long-term financial objectives. However, there are numerous ways to avoid being financially crippled.